Stock Market Crash in 2020 Due to Coronavirus

This newsletter is intended to help investors understand the stock market decline during a very devastating coronavirus that has caused thousands of deaths worldwide. The stock market dropped more than 30% and it was the fastest drop in stock market history. Financial advisors have had their hands full helping investors stay invested and helping their clients make the right investment decisions.

As my family and I watched the market drop so fast, we didn’t really have a chance to sell due to how fast it dropped before seeing losses that seemed to late to sell. Although it is very hard to stay invested when a stock market is dropping, there can be a benefit of increasing your wealth over time by reinvesting your dividends at lower stock prices and investing in your retirement at lower prices. This is called dollar cost averaging. Also it is an important strategy to remember as investors experienced this during the 2008 financial crisis and they will tell you they have increased their wealth for staying invested, including the author.

My wife, our three children, and I all understand the stock market pretty well. We all talked about the decline and felt the stock market would recover once the virus was contained and Americans were able to go back to work. My oldest son is a financial advisor who explained to my wife and I an excellent analogy that the stock market was in a steep correction that it was like a knife falling from the sky and would eventually would land and hit a bottom in a matter of time, so try to be patient. Also, he said the market will come back. My youngest son who is a software engineer in the financial sector reminded me how important it is to review technical analysis that might indicate a bottom and we will show you how in this article. My daughter is a director for a pharmaceutical company and my wife is trauma registrar at a hospital. They both have been very supportive during this tough time. The economy is now in a recession and the coronavirus is spreading, it is tough to digest. I came to the conclusion that it was okay to take some profits and add to your cash account during this time, though we still are fully invested at the time of writing this article.

The stock market does seem like investors pushed the panic button and their fear shows how quickly the stock market moved to a possibly bottom as you can see on the S&P 500 Index chart below. It shows the market moved down very fast breaking the 2300 mark and than hitting a bottom at 2200 on March 23,2020. It is hard to call a bottom though it does seem like it did reach a bottom. The indication of a market bottom is due to how the market went up after the US Federal Government passing of a 2 trillion dollar stimulus bill on Tuesday March 24,202. It took the S&P 500 back up to 2400. The stimulus bill was designed to help Americans and businesses through the recession caused by the novel cornonavirus as well as the US Federal Reserve helped by adding liquidly into the economy more than one time. Also notice on the top left corner of chart below you can see the S&P 500 index increased to 2874.56 on April 17, 2020. Good News!

What this means for all of us investors is we can look forward to going back to our CFE Finances investing principles using fundamentals and technical analysis. Keeping in mind the scary novel coronavirus has shown us how important it is for all of us to continue our six foot or more social distancing with all our contacts including our friends, relatives, and coworkers. Since the novel coronavirus is still spreading rapidly, we need to stay positive and help each other when we can. Though reviewing stocks and their financials is one way to pass time productively.

Also below is chart of the S&P 500 ETF (SPY) that showed the same > 30% percent drop as the S&P 500 index above. On the chart below you can see the three indicators the 50,100 and 200-days moving averages. It is important to point out the S&P 500 ETF (SPY) blue trend line dropped to 225.00 caused by the stock market dropping in such a short period of time (about two weeks). The purple line shows the the 50-day moving average 292.49, the light blue line shows the 100 day-301.32 and the yellow line is the 200 day-305.99 moving averages. The best indicator of the chart is the upward trend line in blue that shows the S&P 500 ETF (SPY) moved up from the lows and reaches 264.86 in red. Also notice the chart on the top left coriner indicates the SPY ETF has improved to 286.54 on Friday April 17,2020. More good news!

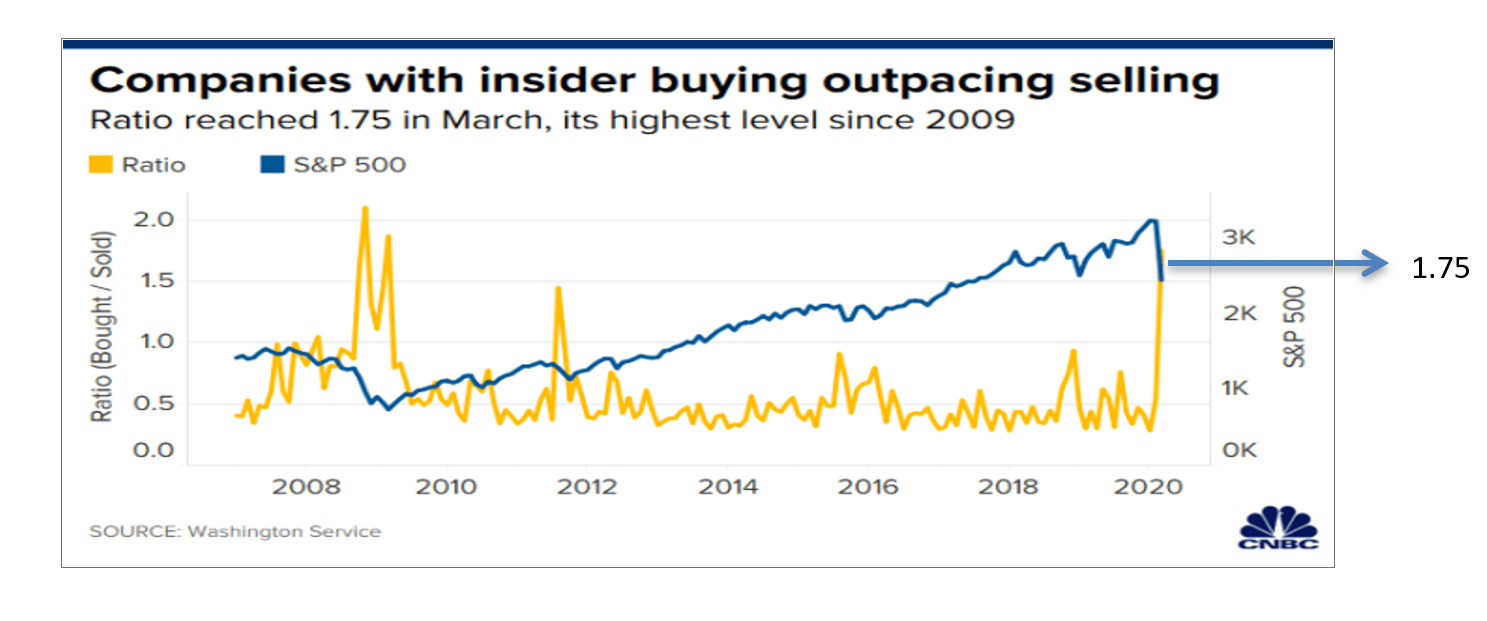

Another chart below shows insider buying into company stocks by outpacing the selling during the time the stock market was trending to the bottom of chart. The ratio indicates a 1.75 for March 2020; it’s the highest since March of 2009 according to Washington Service a provider of insider-trading and data analytics. The ratio normally is below 1.00 that means more executives (insiders) are selling their stock. This is good news for investors because the executives are showing confident that their company have enough cash to handle the down turn do to the coronavirus and also indicates their stock price will appreciate in the future. The two companies that were mentioned in article were Dell and Well Fargo. Also other companies were mentioned that hold a large stake in a companies stocks that have been buying millions of dollars of their affiliated stocks. Some examples are Berkshire Hathaway bought $45 million worth of Delta Air Lines; Blackstone bought more than of $50 million of Cheniere Energy. Remember the stock market is always looking into the future of company profits. Approximately six months ahead of the existing economy.

As we live through the coronavirus and the stock market there has been some very good days recently in the markets (best 3 day rally since 1930s March 24-March 26,2020) that have shown some promising come backs in investments you probably own or could own. Everyone needs to keep studying company stocks and invest for the long term and it will pay off handsomely in the future. Good luck and happy investing from CFE finances! Stay safe and healthy! We will be in touch with another newsletter soon. If you have any questions or concerns email us from our contact page.